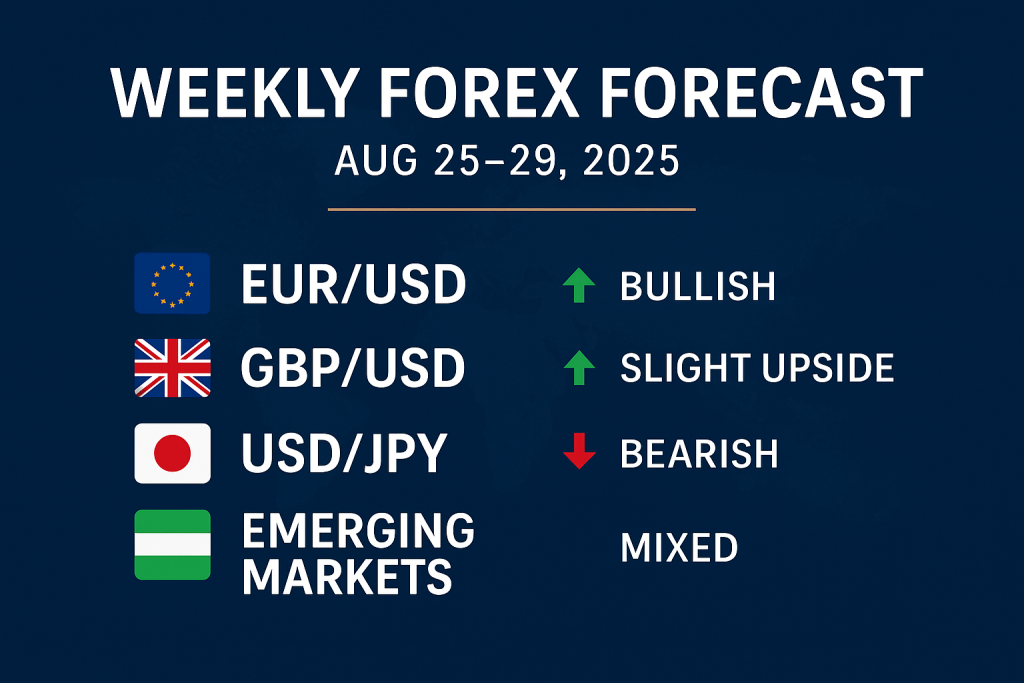

Weekly Forex Forecast: What to Watch (Aug 25–29, 2025)

Powered by GFX Securities

1. EUR/USD – Bullish Momentum on Fed Dovish Shift

The EUR/USD is leaning bullish following dovish remarks by Fed Chair Powell, which dampened the dollar and lifted the euro Forex CrunchFXStreet. Positive Eurozone PMI data also supports this trend Forex Crunch. On the technical side, analysts note that a breach of resistance could pave the way for further upside Action ForexFXStreet.

Outlook: Expect continued strength in EUR/USD if U.S. data disappoints or Powell reiterates dovish tones. Key resistance around 1.17 remains pivotal.

2. GBP/USD – Back Above 1.35 Amid Weak Dollar

GBP/USD is holding near 1.3527, rebounding from earlier lows following U.S. rate cut speculation Trading News. Forecasts suggest further upside, particularly against the dollar, although performance versus the euro is mixed Currency News.

Outlook: Sustained dollar weakness could drive GBP/USD higher, but this remains dependent on U.S. developments and UK-specific data.

3. USD/JPY – Bearish Turns as BoJ Hints at Support

The dollar is under pressure against the yen, particularly as markets price in potential supportive actions from the Bank of Japan and rising rate cut bets from the Fed FXEmpire.

Outlook: If Japanese inflation and retail sales data suggest further stimulus, the yen could gain ground this week.

4. Broader Dollar Sentiment – Mixed Conditions Ahead of Key U.S. Data

A stronger dollar emerged late in the week ahead of Powell’s Jackson Hole speech, though rate cut odds have declined slightly to ~70% Reuters+1. Markets are now awaiting U.S. PCE, jobless claims, housing data, and GDP releases—all expected to drive sentiment in the days ahead MarketsFXEmpireForex Crunch.

Outlook: A softer-than-expected PCE or labor data could reignite rate cut bets and weaken the dollar broadly; conversely, strong data could stall the dollar’s downside.

5. Emerging Markets – Currency Turbulence and Divergences

-

Ghanaian cedi is expected to weaken, pressured by corporate demand and tight dollar supply Reuters.

-

Yuan faces bearish sentiment as China’s weak macro data fuels more short bets Reuters.

-

Other African currencies—Kenyan shilling, Nigerian naira, Ugandan shilling, Zambian kwacha—are expected to remain relatively stable Reuters.

Outlook: Volatility in select emerging currencies may provide trading opportunities, but caution around policy risk remains critical.

Summary Table

| Pair / Region | Key Drivers | Expected Direction |

|---|---|---|

| EUR/USD | Fed tone, Eurozone PMIs | Bullish, resistance near 1.17 |

| GBP/USD | Dollar strength, UK data | Slight upside/gain |

| USD/JPY | BoJ stance, U.S. data | Yen support, dollar weakening |

| U.S. Dollar | U.S. macro releases | Volatile – data-dependent |

| Emerging Currencies | Local policy, demand/supply | Mixed; some under pressure |

Trading Tips for the Week

-

Watch U.S. data closely: PCE, jobless claims, GDP can dramatically sway FX sentiment.

-

Technical triggers: EUR/USD resistance at 1.17, watch for breakouts or reversals.

-

Cross-pair strategies: Weakness in USD may benefit GBP and EUR crosses like EUR/GBP or GBP/JPY.

-

Emerging markets: Ghanaian cedi and yuan may offer opportunities—but involve elevated risk.